Rates

Let your money do the work for you with great rates.

Let your money do the work for you with great rates.

There's more to a credit union than just banking.

We know that strong financial literacy is key to making informed decisions about money.

We offer industry leading business account rates.

Connect with our Business Banking team

Located at 45 King Street East in Hamilton.

Meet our Wealth Team

Our wealth advisors are here to provide expert guidance and support.

We know that strong financial literacy is key to making informed decisions about money.

We know that strong financial literacy is key to making informed decisions about money.

We’ve listed some frequently asked questions in case you were wondering the same thing. If you don’t find what you are looking for, give our Member Service Centre a call and we will get you the answers you need.

During business hours, call our Member Service Centre at 1‑800‑616‑8878 or visit your nearest branch.

After hours, call Everlink at 1‑888‑277‑1043. 7 days a week.

A Debit Mastercard is similar to a Interac Flash debit card in that it functions the same way for in-person point of sale and ATM transactions (Interac Flash is a payment technology that allows you to make smaller, everyday purchases simply by holding your debit card up to an Interac Flash-enabled point-of-sale terminal – no PIN required).

Where a Debit Mastercard is different is, it has the ability to transact on the Mastercard network which supports what’s known as “card-not-present” transactions like online purchases and recurring payments, functioning just like a credit card but transacting directly from your chequing account (if you do not have a chequing account it will draw from your savings account). For example, you can set up your Netflix account to use your Debit Mastercard to make the payments, instead of a credit card.

In general, everyone who is eligible for a Flash debit card is equally eligible for a Debit Mastercard. Parents signing on behalf of minors will need to be aware of the additional features of the card.

There are no unique transaction fees or annual fees for having a Debit Mastercard. All standard account and transaction fees apply. Should a trace be required for a Debit Mastercard transaction, the fee may be higher due to increased costs to investigate.

Domestic point of sale transactions will continue to work the same for the Debit Mastercard. International point of sale transactions will be made using the Mastercard network but transactions themselves will continue to operate the same way. Note that there are additional fees for using the card outside of country.

No, the Debit Mastercard is a debit card that has the ability to transact on the Mastercard network. That means there is no associated credit limit with the card and it will not display on your credit bureau.

Transaction limits will continue to follow the same process as we use today for Flash cards.

No, both online and point of sale transactions are aggregated and must be within the daily point-of-sale limit. If you make frequent online purchases you can request temporary card limit increases or request a fixed higher card limit for your card in accordance with FirstOntario’s policies for limits.

While the Debit Mastercard will operate more reliably for international transactions than a Flash card, you should always bring another form of payment when you are travelling and not rely solely on any single means as every card network internationally has gaps and limitations.

With these cards operating on the Mastercard network they are expected to be more reliable for international transactions, however it is entirely dependent on the network capabilities of the merchant’s point of sale provider and their ability to accept Debit Mastercard.

Some retailers will not charge an account until the item has shipped, e.g., Amazon. Where that’s the case, a hold is placed on the account in the interim until the seller clears the transaction. Once the transaction is processed, the hold will be lifted.

Most holds are lifted within three to seven days, however international transactions may have holds up to 30 days placed on the account. Holds will be lifted when the seller completes the transaction.

Some merchants will have additional security enabled with Mastercard to help prevent fraudulent transactions at the point of sale. When this is the case, you will be sent a one-time passcode to verify the transaction.

A one-time passcode is an authentication code sent through email or SMS during an online purchase (card-not-present), only if the merchant participates and deems the transaction to be high-risk. The one-time passcode provides an extra layer of security to validate who is attempting the online purchase. If you receive and validate a one-time passcode, the transaction will process.

If you are unable to validate the one-time passcode, the transaction will be declined. It is important that your details (i.e., name, home address, mobile number, email address) are accurately kept up to date. If your details are not accurate, online purchases may be declined and/or you may not be able to action the one-time passcode to finalize the purchase.

If you do not have an accurate email or phone number on file with FirstOntario, this process cannot be completed and it is recommended that you call our Member Service Centre to address the missing information and get further assistance.

A variety of reasons could contribute to a failed transaction including:

If you wish to have a Debit Mastercard now, you may do so by visiting your branch to obtain the card in person or contact our Member Service Centre at 1-800-616-8878 to review other options available.

If you can't remember your PIN or if you are locked out, you can reset it at any one of our Personal Assisted Teller machines. You will need a mobile device so you can sign the applicable form electronically. You can also come to a branch to do this. Please make sure you have at least two pieces of valid photo identification.

If you know your PIN, but you want to change it to something different, you can change it at any FirstOntario or THE EXCHANGE Network ATM. Use this ATM locator to find the machine closest to you.

Visit your branch or connect with our Member Service Centre at 1-800-616-8878 to find out your debit card and ATM withdrawal limits.

If you’re planning on making a large purchase, you can request a temporary increase to your limit.

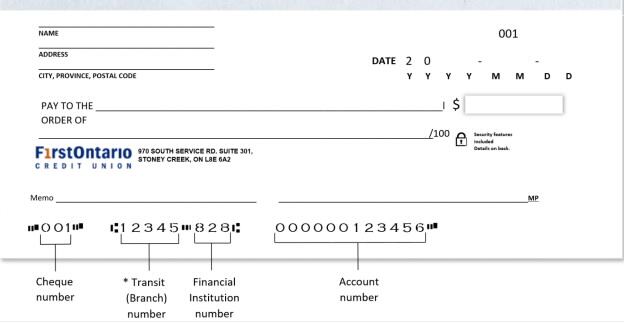

A void cheque can be used to set up a direct deposit or pre-authorized debit instructions on your account.

Three sets of numbers are taken from the bottom of your cheque when the instructions are set up – the transit number, the institution number and your account number. Here’s where you’ll find them:

Did you know you can also create a direct deposit switch through our free ClickSWITCH service? If you’re not familiar with the service, visit our ClickSWITCH page to learn more.

If you don’t have cheques, you can obtain a void cheque or a pre-authorized debit (PAD) form by logging in to online or mobile banking:

You can log in through our mobile app, tap Scheduled and choose the payment you would like to cancel, then select Delete.

In online banking, select Payments in the menu on the left. Go to View/Modify Scheduled Payments, choose the scheduled payment you wish to cancel, then hit Delete. You will then have to Confirm to complete the update.

Visit Account Services through your online banking and select Order cheques. You can also visit your branch or call our Member Service Centre at 1-800-616-8878 and our staff can make the arrangements for you.

For our Business Members, cheques must be ordered through your branch.

Some Members will have immediate access to a limited amount of the funds they deposit one of our ATMs. The remaining funds will be held for a short time.

This hold period allows our credit union to verify that the funds will be available from the account at the other financial institution on which the cheque and/or other negotiable items are drawn. Member-specific circumstances will determine what they can access right away and if longer holds are required.

Please don't hesitate to contact us at 1-800-616-8878 if you have any questions.

Holds are placed on Member’s accounts to protect you and the credit union against possible losses and/or fraudulent activity. Our guidelines for the duration of holds are below.

| CHEQUE DRAWN | DURATION (IN BUSINESS DAYS) |

|---|---|

| In Province | 5-10 |

| In Province (new Member) | 7-10 |

| Out of Province | 10-20 |

| United States | 30 |

| All cheques for Members who declined Credit bureau authorization when Membership was opened | 30 |

To avoid having a hold placed on your account, you may wish to set up direct deposit arrangements with the sender if it’s a payment you’ll be receiving regularly.

You can also arrange to receive the money by Interac e-Transfer® if the funds are coming from a Canadian financial institution in Canadian dollars. This is another option to transfer money that’s safe, easy and immediately available.

Statement preferences are controlled by the primary account holder on an account.

If you are currently receiving paper statements in the mail and they are addressed to you, you can change your preference in online banking to receive only eStatements.

If you are a joint account holder and the mailed statement is not addressed to you, you will not be able to switch that paper statement as it will need to be switched by the primary account holder.

All Members are set up to automatically receive eStatements in online banking. You can stop paper statements from being mailed to you by changing your preference in online banking. Simply log in to online banking and follow these simple steps:

Depending on timing of completing these steps, you may still receive one more paper statement mailing after cancelling paper statements.

Your eStatement can be found by logging in to online banking and following these simple steps:

To send a wire transfer, visit a branch with the following information about the recipient's account:

A wire transfer takes approximately three to five business days to be processed. For rates and fees, please refer to the Fees page.

The person sending the wire transfer to your FirstOntario Credit Union account must provide the following information to their financial institution:

If the account, name or address listed on the incoming wire transfer does not match exactly to your FirstOntario Credit Union profile, funds may be returned to the sender.

Once a wire payment has been sent from another financial institution, it takes three to five business days until FirstOntario Credit Union receives the funds. Timing depends on the currency sent, where the sending financial institution is geographically located, and how many intermediary banks the sending financial institution needed to use for the transfer.

In addition, you will need to provide the sender with the following information:

| ADDITIONAL DETAILS | |

|---|---|

| SWIFT BIC | CUCXCATTVAN |

| Financial Institution | Central 1 Credit Union |

| Address | 1441 Creekside Drive, Vancouver BC, V6J 4S7 Canada |

For all international wires (not including U.S.), funds will be posted in Canadian funds.

Please note there may be additional foreign exchange fees. For rates and fees, please refer to the personal banking fees page.

The person sending the wire transfer to your FirstOntario Credit Union account must provide the following information to their financial institution:

If the account, name or address listed on the incoming wire transfer does not match exactly to your FirstOntario Credit Union profile, funds may be returned to the sender.

Once a wire payment has been sent from another financial institution, it takes three to five business days until FirstOntario Credit Union receives the funds. Timing depends on the currency sent, where the sending financial institution is geographically located, and how many intermediary banks the sending financial institution needed to use for the transfer.

In addition, you will need to provide the sender with the following information:

| ADDITIONAL DETAILS | |

|---|---|

| SWIFT BIC | CUCXCATTVAN |

| Financial Institution | Central 1 Credit Union |

| Address | 1441 Creekside Drive, Vancouver BC, V6J 4S7 Canada |

Please note there may be additional foreign exchange fees. For rates and fees, please refer to the personal banking fees page.

The person sending the wire transfer to your FirstOntario Credit Union account must provide the following information to their financial institution:

If the account, name or address listed on the incoming wire transfer does not match exactly to your FirstOntario Credit Union profile, funds may be returned to the sender.

Once a wire payment has been sent from another financial institution, it takes three to five business days until FirstOntario Credit Union receives the funds. Timing depends on the currency sent, where the sending financial institution is geographically located, and how many intermediary banks the sending financial institution needed to use for the transfer.

In addition, you will need to provide the sender with the following information including our U.S. correspondent/intermediary bank:

| PAY DIRECT TO | |

|---|---|

| SWIFT BIC | CITIUS33XXX |

| ABA# | 021000089 |

| Financial Institution | Citibank N.A. |

| Address | New York, USA |

| BENEFICIARY BANK | |

| SWIFT BIC | CUCXCATTVAN |

| Financial Institution | Central 1 Credit Union |

| Citibank Account No. | 36371006 |

If you hold a U.S. dollar account with FirstOntario Credit Union, ensure you provide the correct account for the currency you wish to receive. If FirstOntario Credit Union receives the wire payment in a currency that is different from the currency of your deposit account listed on the wire payment, the funds will be converted to the currency of your account.

Please note there may be additional foreign exchange fees. For rates and fees, please refer to the personal banking fees page.

Interac Flash® is a registered trademark of Interac Inc. used under license. To learn more, visit interac.ca*

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Privacy and security • Legal • Accessibility • Market Conduct Code • View all online policies • Site map

FirstOntario Credit Union © Copyright 2026